All Categories

Featured

Table of Contents

However, maintaining every one of these acronyms and insurance kinds directly can be a frustration - va mortgage life insurance. The following table puts them side-by-side so you can rapidly differentiate amongst them if you obtain perplexed. An additional insurance protection type that can settle your home mortgage if you die is a standard life insurance policy policy

A is in location for a set number of years, such as 10, 20 or 30 years, and pays your recipients if you were to pass away during that term. A gives protection for your whole life span and pays out when you pass away.

One usual guideline is to aim for a life insurance policy plan that will certainly pay out up to 10 times the insurance policy holder's income amount. Alternatively, you might choose to make use of something like the cent method, which includes a family members's financial debt, revenue, home loan and education expenditures to determine how much life insurance policy is needed (what does mortgage insurance cover).

There's a factor brand-new property owners' mail boxes are frequently pestered with "Last Possibility!" and "Urgent! Action Needed!" letters from mortgage defense insurers: Numerous only permit you to purchase MPI within 24 months of closing on your home loan. It's also worth noting that there are age-related restrictions and thresholds imposed by almost all insurers, that typically won't give older buyers as lots of alternatives, will bill them a lot more or might deny them outright.

Below's how mortgage defense insurance coverage determines up against standard life insurance. If you're able to certify for term life insurance, you need to avoid home mortgage security insurance policy (MPI).

In those circumstances, MPI can give wonderful tranquility of mind. Every home loan security option will have many rules, laws, advantage options and drawbacks that require to be evaluated very carefully versus your precise scenario.

Why Do You Need Life Insurance On A Mortgage

A life insurance coverage plan can aid repay your home's home loan if you were to die. It is just one of lots of ways that life insurance policy may aid safeguard your liked ones and their monetary future. Among the very best ways to factor your home loan into your life insurance policy requirement is to speak with your insurance policy representative.

Instead of a one-size-fits-all life insurance coverage policy, American Family Life Insurance Firm offers policies that can be created especially to satisfy your family members's needs. Below are several of your options: A term life insurance policy policy. mortgage protection insurance for job loss is energetic for a certain amount of time and generally uses a larger amount of insurance coverage at a lower price than a permanent plan

A whole life insurance policy policy is just what it sounds like. Instead of only covering an established variety of years, it can cover you for your entire life. It likewise has living advantages, such as cash value buildup. * American Domesticity Insurer offers different life insurance policy plans. Talk with your representative about personalizing a plan or a combination of policies today and obtaining the comfort you are worthy of.

Your representative is a great source to address your questions. They may likewise have the ability to aid you discover spaces in your life insurance policy coverage or brand-new means to save money on your other insurance coverage plans. ***Yes. A life insurance coverage beneficiary can select to utilize the fatality benefit for anything - mortgage loan insurance. It's a great means to assist safeguard the financial future of your family if you were to die.

Life insurance is one method of assisting your household in repaying a mortgage if you were to pass away before the home loan is completely settled. No. Life insurance policy is not necessary, yet it can be an essential component helpful see to it your loved ones are economically shielded. Life insurance policy proceeds may be utilized to help repay a home mortgage, but it is not the like home loan insurance policy that you could be called for to have as a problem of a finance.

Martin Lewis Mortgage Protection

Life insurance policy might help guarantee your residence remains in your family members by providing a survivor benefit that might aid pay down a mortgage or make essential purchases if you were to pass away. Contact your American Family members Insurance representative to discuss which life insurance plan best fits your requirements. This is a quick description of coverage and undergoes plan and/or motorcyclist terms, which might vary by state.

Words life time, lifelong and irreversible are subject to plan conditions. * Any kind of finances drawn from your life insurance policy will certainly accumulate rate of interest. mortgage protection insurance in case of death. Any type of impressive car loan equilibrium (financing plus passion) will certainly be subtracted from the survivor benefit at the time of case or from the money value at the time of surrender

Discounts do not use to the life plan. Policy Kinds: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

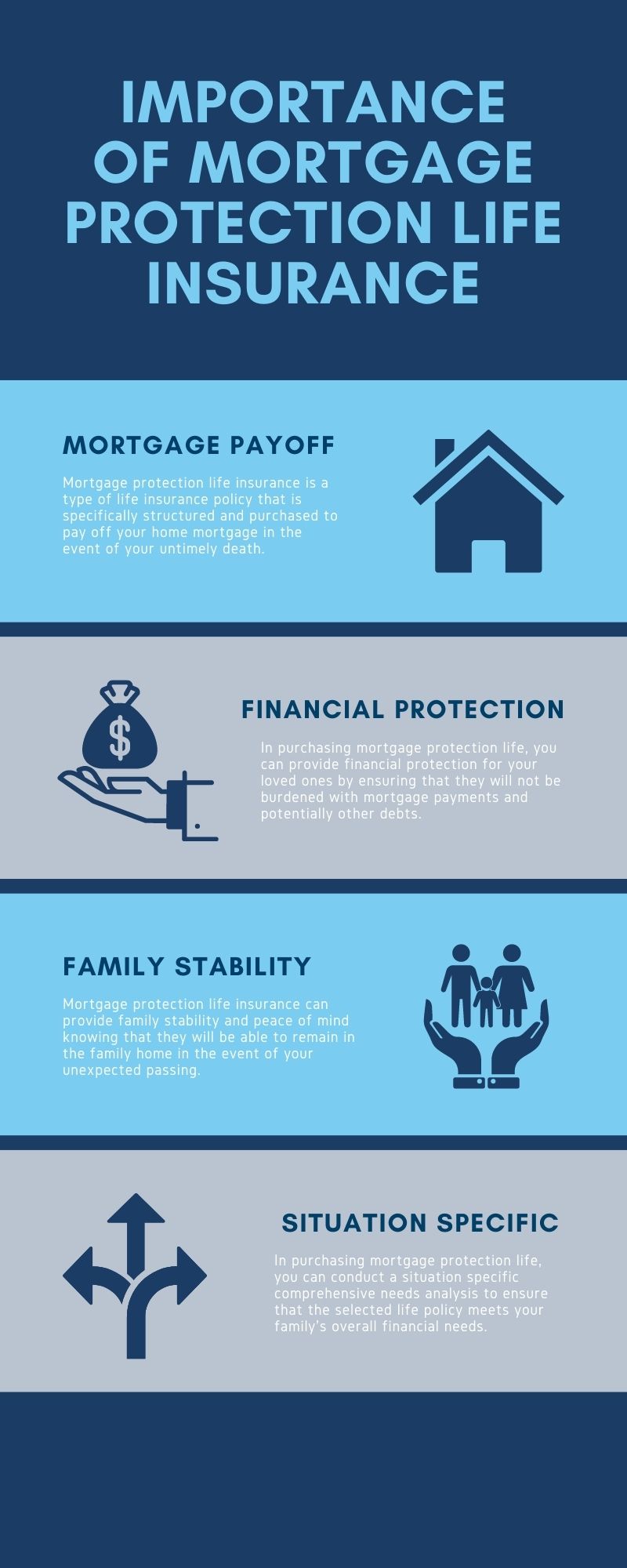

Home loan security insurance policy (MPI) is a various type of secure that could be useful if you're not able to repay your home loan. While that additional protection seems excellent, MPI isn't for everyone. Below's when mortgage protection insurance coverage is worth it. Home mortgage defense insurance policy is an insurance policy that pays off the remainder of your mortgage if you pass away or if you come to be handicapped and can't function.

Like PMI, MIP protects the lending institution, not you. Unlike PMI, you'll pay MIP for the period of the financing term. Both PMI and MIP are needed insurance coverages. An MPI plan is totally optional. The amount you'll pay for home mortgage protection insurance coverage depends upon a variety of factors, consisting of the insurer and the existing equilibrium of your home loan.

Still, there are benefits and drawbacks: The majority of MPI plans are released on a "assured acceptance" basis. That can be helpful if you have a health problem and pay high prices forever insurance or struggle to obtain protection. mortgage protection policies. An MPI policy can provide you and your family members with a feeling of security

Home Protection Insurance Scheme

It can also be practical for individuals that do not get approved for or can not manage a standard life insurance policy policy. You can select whether you require home loan protection insurance policy and for for how long you require it. The terms typically vary from 10 to three decades. You may want your home mortgage defense insurance policy term to be close in size to how long you have left to settle your mortgage You can terminate a home mortgage defense insurance coverage policy.

Latest Posts

Final Expense Life Insurance South Carolina

Funeral Policy With No Waiting Period

Final Expense Telesales Companies